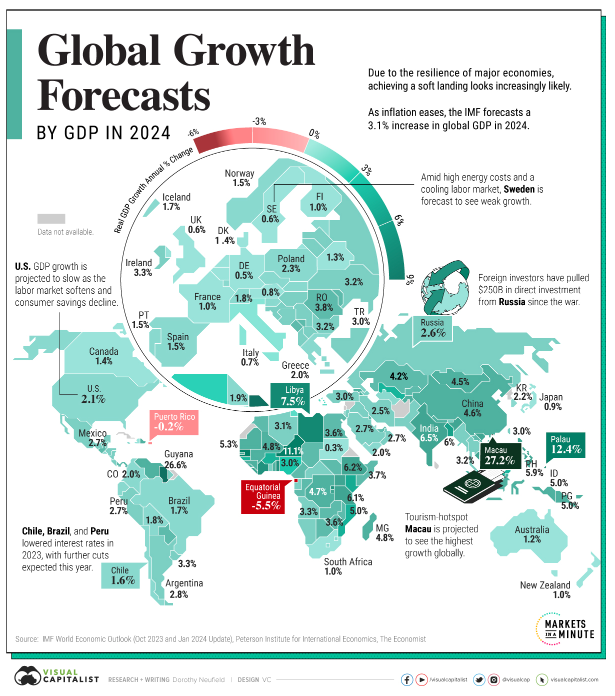

What’s the outlook for global growth in 2024?

Global Gross Domestic Product (GDP) is projected to grow at 3.1% in 2024 and 3.2% in 2025. This is 0.2% higher than the October 2023 International Monetary Fund (IMF) forecast. The slightly improved outlook is due to unexpected strength in the United States and several emerging/developing economies. The forecast is below the historical (2000–19) average annual growth of 3.8%, largely due to elevated interest rates.

https://www.visualcapitalist.com/gdp-growth-forecasts-by-country-in-2024/

https://www.imf.org/en/Publications/WEO/Issues/2024/01/30/world-economic-outlook-update-january-2024

How likely is a global recession?

As the IMF stated in January, ‘with disinflation and steady growth, the likelihood of a hard landing has receded, and risks to global growth are broadly balanced.’

The probability of a global recession in the coming months has fallen. However, it will be largely dependent on activity in the US, as several European and Asian nations are experiencing recessions or significant slowdowns. Slowing global manufacturing has impacted exports, and it is becoming increasingly likely that we will see a series of rate cuts that will bolster growth. In the December quarter, the UK slid into a technical recession, with the Bank of England likely to cut rates this year, lagging behind the US Federal Bank and the European Central Bank (ECB) rate cuts.

Could surprising US inflation data delay US interest rate cuts?

We ended 2023 without the US recession that had been widely predicted. The US economy grew by around 3.3% last year, but is expected to slow to around 1.6% in 2024. Most market watchers now think the most likely outcome is a soft landing. However, a soft landing would be a rare outcome as most Federal Bank tightening cycles result in hard landings.

Recessions are very hard to predict. One contributor to the US avoiding a recession is the volume of ongoing government stimulus. Another is the COVID-19 accumulated savings buffers, which have now largely depleted.

The US Federal Reserve is projecting 3-4 rate cuts this year, in line with market predictions of around a 0.88 percentage point drop, with a 90% chance of a US rate cut in June. Only a few months ago, several more rate cuts were expected in 2024. Markets are anticipating the Eurozone to ease in June, the Bank of England in August, and the Reserve Bank of Australia (RBA) in September.

China is a mixed bag

China is still feeling the effects of COVID-19 lockdowns. The Chinese property market is struggling, and China’s aging population has impacted productivity levels. Chinese equity markets are feeling the strain, down 40% since the highs of 2021.

The magic 2% …sticky inflation and interest rates

Most of the conversation and debate has centred around inflation, globally and closer to home, and the likely impact this will have on interest rate cuts. All eyes are on that magic 2% inflation rate central banks aim to achieve. This target may be tricky in Australia as we have fairly sticky (persistent) service-based inflation. We are seeing some upward pressure on wages across much of the developed world.

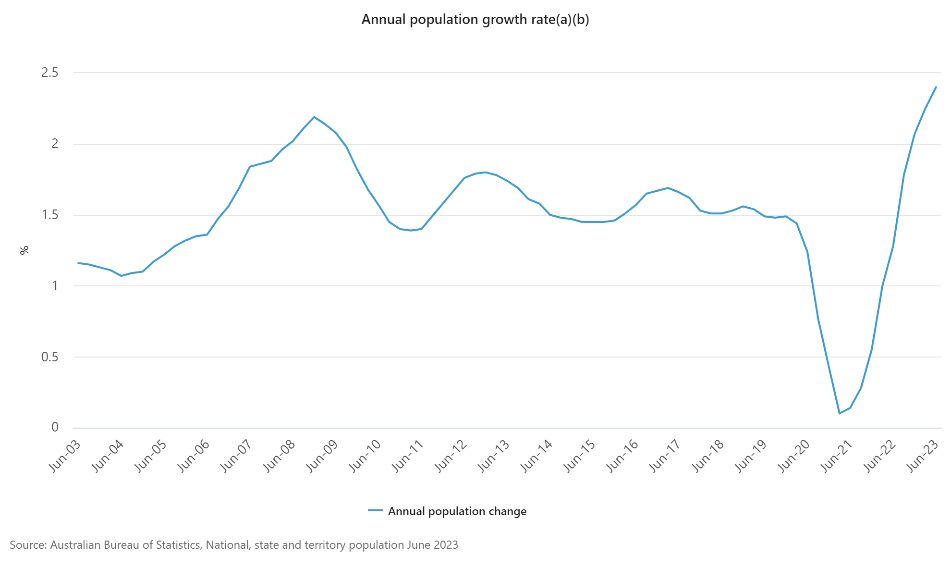

In Australia, there are several factors contributing to our sticky inflation. First and foremost is our immigration surge, stimulating the economy in 2023. In addition, there is also significant stickiness in terms of utility prices and wage inflation in Australia.

https://www.abs.gov.au/statistics/people/population/national-state-and-territory-population/latest-release

The RBA is likely to be one of the more timid of the central banks, as it started tightening later and didn’t raise rates as high, with expectations of rate cuts scaled back from nearly 3 to less than 2 in 2024. It is likely that the RBA will wait until the US and other major central banks have actually started cutting rates.

What does this mean for markets?

We continue to view markets cautiously.

2023 was a bit of a rollercoaster as markets attempted to predict interest rate peaks and the timing of rate cuts. Lower bond yields and expected rate cuts resulted in strong rallies for most equity markets. The S&P 500 returned 25.5% in 2023, while Europe returned 15%. Australia lagged with a return of 12.4%. Most of the rally in stocks during 2023 was due to Price to Earnings (PE) ratings rather than from higher earnings.

In the US, earnings are estimated to have increased around 4% in the 2023 calendar year, while in Australia, they are expected to be down around 5% in the 23-24 Financial Year. Artificial intelligence (AI) was the big theme of the year, with the hope it will boost productivity for a whole range of companies.

The rally has resulted in equity valuations looking a bit expensive. The Australian equity market (ASX 200) was trading on a PE ratio of 16.4 times at 31 December 2023. This was 12% above the 20-year average of 14.6 times (JP Morgan). An illustration of this is the big rally in bank stocks, with CBA trading at just under 20 times this year’s earnings estimate. US equities are currently trading on a forward PE of 21.0x (S&P 500 at 5,087, Refinitiv, 16 Feb 2024). Given the recent rally, we are fairly cautious about adding to growth assets right now. We may look at possibly reducing our allocation to long term fixed interest rate bonds if bond yields fall, and instead allocate the funds to high quality floating rate corporate bonds, as this may present a better risk/reward trade off.