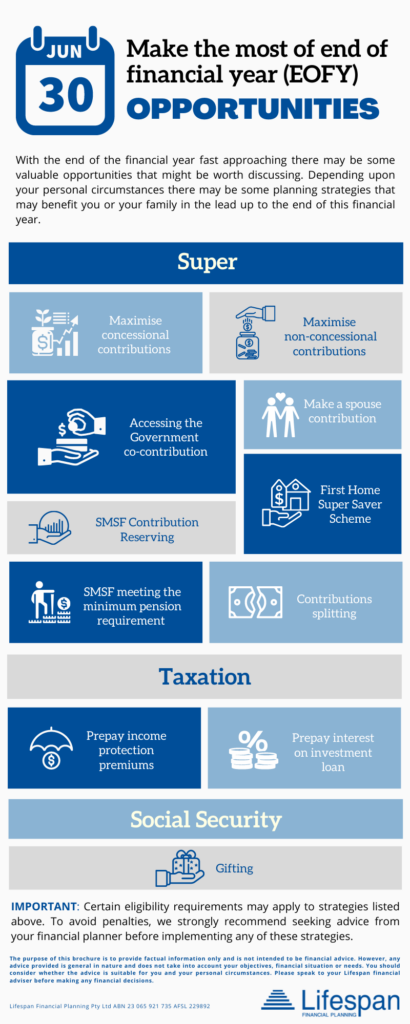

With the end of the financial year drawing near there may be some valuable opportunities that may be worth discussing. Depending on your personal circumstances, there may be some beneficial planning strategies you can implement before 30 June.

Important: Certain eligibility requirements may apply to strategies listed below. To avoid penalties, we strongly recommend seeking advice from your financial planner before implementing any of these strategies.

Self-managed superannuation

| Pensions | If you currently receive a pension, should check you have taken the minimum pension before 1 July 2023. If you fail to do so, the account will be considered to be in accumulation phase for the whole financial year with up to 15% tax applied to the earnings and realised capital gains.

With the upcoming indexation of Transfer Balance Cap (TBC) from $1.7m to $1.9m in July 2023, there may be an opportunity for you to transfer more to the pension account if it commences on or after 1 July 2023, instead of commencing before 30 June 2023. If you start your first retirement phase income stream on or after 1 July 2023 your TBC should be $1.9 million. If you commenced your retirement phase income streams prior to this date and have not reached or exceeded your personal TBC, you may benefit from indexation, but only on a proportional basis. |

| Reserving | Concessional contributions made in June can be allocated immediately to a member’s account (to count against this year’s cap) or added to a contribution reserve and then allocated to the member’s account in July (within 28 days from the start of the financial year) to count against next year’s cap [ATO TD 2013/22]. This may help to bring forward tax deductions if you can claim personal tax deductions for contributions. |

| Investment strategies | Review your SMSF investment strategy to ensure it is still current and relevant. Document this review in trustee minutes and make any changes necessary to the documentation. |

| In-house assets | Ensure that in-house assets do not exceed 5% of total assets as at 30 June 2023. |

Superannuation contributions

| Non-concessional contributions | The FY 2022/23 is the first year when individuals below age 751 are able to make non-concessional contributions to superannuation and even utilise the bring forward arrangement without having to meet the work test.

To be able to make non-concessional contributions before 30 June 2023, your Total Superannuation Balance (TSB) on 30 June 2022 must have been below $1.7m. The following table explains potential amounts that may be brought forward based on the TSB on 30 June 2022 assuming you’re below age 75 on 1 July 2022 and below age 75 at the time of making the contribution:

Future opportunities to make non-concessional contributions If you currently do not meet the requirements to make non-concessional contributions to super due to your TSB being in excess of the current cap of $1.7m, you may have an opportunity to revisit the strategy post 1 July 2023 as the TSB cap will increase from $1.7m to $1.9m on 1 July 2023. |

|||||||||||||||||||||

| Concessional contributions | Consider maximising concessional contributions to take advantage of the full concessional contribution cap.

The standard concessional contributions cap is $27,500 per person for the financial year in 2022/23. Carry forward rules may be used if your TSB was below $500,000 on 30 June 2022, and if you have unused concessional caps from previous financial years (starting from the FY 2018/19). If eligible and you’re below age 67 you are able to make these contributions without having to meet the work test. If eligible and you’re aged between 67 & 75, you must meet the work test2 or meet the one-off work test exemption3 rules to be able to make personal deductible contributions. If you’re eligible to claim a tax deduction for personal contributions, you need to ensure the contributions are received by the fund before 1 July, or even earlier as certain funds will have their own cut off times. If using a clearing house or a bank transfer, time needs to be allowed for the transaction to be processed and received by the super fund. Before claiming the deduction, you should also ensure you have also lodged notification of the intention with the super fund trustee. |

|||||||||||||||||||||

| Co-contribution | If your adjusted taxable income is below $57,017, consider making a non-concessional contribution to receive a co-contribution. The co-contribution is paid at the rate of 50 cents for each eligible dollar contributed. The maximum co-contribution of $500 is available if your income is below $42,016.

However, there are a number of other requirements to be met before the co-contribution can be paid. |

|||||||||||||||||||||

| Spouse contribution | If one member of a couple has adjusted taxable income of less than $40,000, the other spouse may be eligible to contribute up to $3,000 into their spouse’s super and receive a tax offset of up to $540.

However, there are other requirements to be met before the making a spouse contribution and accessing the tax offset. |

|||||||||||||||||||||

| Super splitting | If you’re eligible and want to split the concessional contributions made during the previous financial year, you must submit a request to your super fund by 30 June of the current financial year | |||||||||||||||||||||

TTR strategy

| TTR strategy | If you’re reaching age 65 between now and 30 June 2023 with balances of close to $1.7m in the TTR pension, you may wish to consider speaking to your financial planner as there may be an opportunity for you to take advantage of the upcoming indexation of the Transfer Balance Cap. |

Centrelink

| Gifting | The gifting limit of $10,000 applies per financial year (up to $30,000 in any 5-year period). If you wish to make a gift to a family member (or other person or entity) and have not used the limit this year, you may wish to make the gift before 1 July 2023 so the full limit becomes available again in July. |

Taxation

| Tax deductible expenses | Prepayments can be made for up to 12 months of deductible expenses to bring forward the tax deduction. |

| Offset capital gains/losses | If your assets have been sold during the year that realised either a capital gain or loss, a discussion with your financial planner or the tax accountant may be beneficial as there may be an opportunity for you to better manage the tax outcome |

Reach out and contact us if you have any questions, so we can help you make the most of these end of year financial opportunities.

The information contained in this article is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional.

We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.

__________________________